About Atal Pension Yojana

Atal Pension Yojana is a pension scheme launched by the Prime Minister of India Shri Narendra Modi in 2015. This pension scheme is mainly targeted at people whose monthly income is very low such as maids, drivers, gardeners, delivery boys, and farmers. Earlier the name of this pension was “Swabalamban Yojana” but due to the failure of the previous scheme with this name it has been replaced as “Atal Pension Yojana”. The common people of India have benefited a lot from this scheme.

Purpose Of This Scheme

- To provide basic economic security by securing a pension life with a pension policy to the middle backward people.

govt of india wants every Indian citizen who are make a very low income per month to join this and be a part of the National Pension System (NPS). By Joining in this Scheme They Can Secure their life after retirement from their work.

Full Overview of Atal Pension Yojna

| Name of Scheme | About Atal Pension Yojana |

| Launched by | Prime Minister Hon’ble Narendra Modi |

| Covered Area | All India |

| Implementation | 9 May 2015 |

| Objectives | Provide pension ( 60 years above old age-eligible persons) |

| Incentive | Rs 1000 , Rs 2000 , Rs 3000 , Rs 4000 , Rs 5000 – per month, based on policyholder investment |

| Beneficiary | OldAged labors, farmer, etc |

| Application Starts | Always Open |

| Process | Offline Registration |

| Official Website | https://www.npscra.nsdl.co.in/scheme-details.php |

Eligibility Criteria

- Must Be citizen In India

- Must Be Between The Age 18-40

- Should Have Ability To Contribute for Minimum 20Years

- Must-Have A bank Account Linked to Aadhar Card

- Applicants Must Have Aadhar Card/Voter ID/Ration Card

- Must Have a Valid Phone No

Benefits

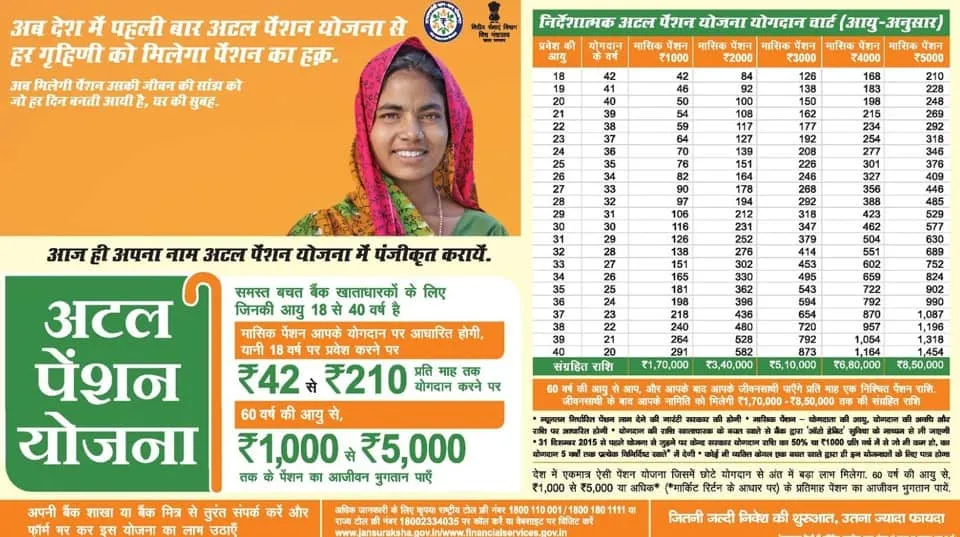

All investors will get a pension of Rs 1000, Rs 2000, Rs 3000, Rs 4000, and Rs 5000 per month after their 60Year age based on their investment by investing very little money every month.

SEE THE FULL CHART OF INVESTMENT AND RETURN REPORT

| AGE OF ENTRY | YEARS OF CONTRIBUTION | MONTHLY PENSION OF RS 1000(Amount You Have To Provide ) | MONTHLY PENSION OF RS 2000 | MONTHLY PENSION OF RS 3000 | MONTHLY PENSION OF RS 4000 | MONTHLY PENSION OF RS 5000 |

|---|---|---|---|---|---|---|

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 453 | 551 | 689 |

| 33 | 27 | 151 | 302 | 414 | 602 | 752 |

| 34 | 26 | 165 | 330 | 453 | 659 | 824 |

| 35 | 25 | 181 | 362 | 495 | 722 | 902 |

| 36 | 24 | 198 | 396 | 543 | 792 | 990 |

| 37 | 23 | 218 | 436 | 594 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 654 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

Penalty

| PENALTY (Delay Month) | PENALTY AMOUNT |

|---|---|

| 1 | Up to ₹100 per month |

| 2 | Up to ₹101 to ₹500 per month |

| 5 | Up to ₹501 to ₹1000 per month |

| 10 | beyond ₹1001 per month |

Required Documents

- Proof of identity( Xerox of Adhar/Ration /Voter Card )

- Proof of address,

- Photo(color)

- Document having date of birth

- Bank Passbook First Page Xerox Copy

How To Apply

All Nationalized Bank Provide This Scheme. You can visit any of these Banks to Start your APY account.

- APY Yojana forms are available online and offline both, you Can download the online form From The Official Website Or click below download button.

- Download The APY Registration Form

- Fill up the Application Form

- Submit a Photocopy Of Your Aadhar Card

- Go To The Nearest Bank and Submit The Application Form

To know more about the scheme visit the official guidelines